rhode island tax table

The Rhode Island tax rate is unchanged from last year however the. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

2022 Rhode Island Sales Tax Table.

. The state sales tax rate in Rhode Island is 7 but. Find your income exemptions. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The state sales tax rate in Rhode Island is 7 but. Details on how to only prepare and print a Rhode Island 2021 Tax Return.

The 2022 state personal income tax brackets are updated from the Rhode Island and Tax Foundation data. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

However if Annual wages are more than 227050 Exemption is 0. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. More about the Rhode Island Tax Tables.

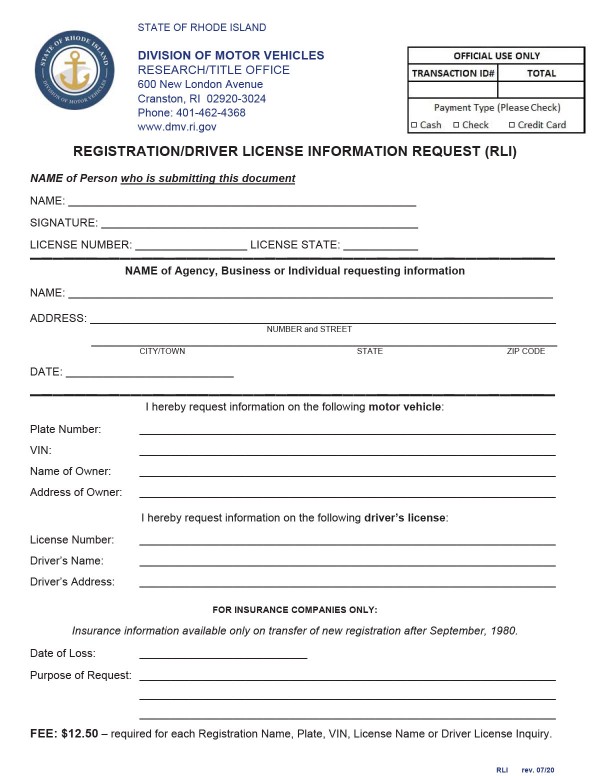

A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. Below are forms for prior Tax Years starting with 2020. Find your gross income.

2017 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. Income tax tables and other tax information is sourced from the Rhode Island Division of Taxation.

This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. Find your pretax deductions including 401K flexible account contributions. The state sales tax rate in Rhode Island is 7 but.

Details of the personal income tax rates used in the 2022 Rhode Island State Calculator are published below. 3 rows Rhode Islands 2022 income tax ranges from 375 to 599. The state sales tax rate in Rhode Island is 7 but you can customize this table as needed to reflect.

Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. Page T-2 Continued on page T-3. Rhode Island State Income Tax Forms for Tax Year 2021 Jan.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Rhode Island tax forms are sourced from the Rhode Island income tax forms page and are. Exemption Allowance 1000 x Number of Exemptions.

Before the official 2022 Rhode Island income tax rates are released provisional 2022 tax rates are based on Rhode Islands 2021 income tax brackets. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Find your pretax deductions including 401K flexible account contributions.

2022 Rhode Island Sales Tax Table. Find your gross income. The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Rhode Island State Income Tax Rates and Thresholds in 2022.

Details of the personal income tax rates used in the 2022 Rhode Island State Calculator are published below. Rhode Islands 2022 income tax ranges from 375 to 599. We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island.

2200 2250 2300 2350 2000 2050 2100 2150 4000 Rhode Island Tax Table 2018 0 50 100 150 200 250 300 350. Rhode Island Income Tax Rate 2020 - 2021. Rhode Island Income Tax Forms.

Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. 2022 Rhode Island Sales Tax Table. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. Find your gross income. These back taxes forms can not longer be e-Filed.

Find your income exemptions. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation.

Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The Rhode Island income tax rate for tax year 2021.

Celia At The Rhode Island School Of Design Library Designed By Nadaaa Library Design Design Modern Design

Ri Tax Credits Financing Rhode Island Commerce

Rhode Island Income Tax Calculator Smartasset

Western Hotel Restaurant Burrillville Ri Http Www Visitingnewengland Com Western Html Hotel Westerns Rhode Island

Amazon Com College Flags Banners Co Rhode Island Pennant Full Size Felt Sports Outdoors

Where S My Rhode Island State Tax Refund Taxact Blog

Rhode Island Income Tax Calculator Smartasset

Rhode Island Property Tax Rate 1 5 Median Home Value 241 000 14th Highest Median Income 58 073 19th Highest Property Tax Property House Styles

Summertime In Burrillville Ri Round Lake Favorite Places Rhode Island

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

1949 Ad For Parkay Margarine Vintage Recipes Retro Recipes Food Ads

Rhode Island Estate Tax Everything You Need To Know Smartasset

Covid 19 Information Ri Division Of Taxation

Colonial Quills How The Colonies Got Their Names Connecticut Urkunde Amerikanischer Unabhangigkeitskrieg

Some Ri Lawmakers Education Labor Groups Want To Raise Tax On Rich

Rhode Island Income Tax Brackets 2020

Chart 2 Colorado Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Income Tax Chart

All About Bills Of Sale In Rhode Island Facts You Need In 2020